CRTC Asked to Fix Broken Cell Phone Market

CIPPIC and OpenMedia filed comments calling on the CRTC to adopt robust regulatory measures necessary to reverse Canada's broken mobile ecosystem. Canadian mobile service providers such as Bell and TELUS extract some of the highest revenues in the world, and the correspondingly high retail costs have prevented Canadians from realizing the full potential of mobile connectivity.

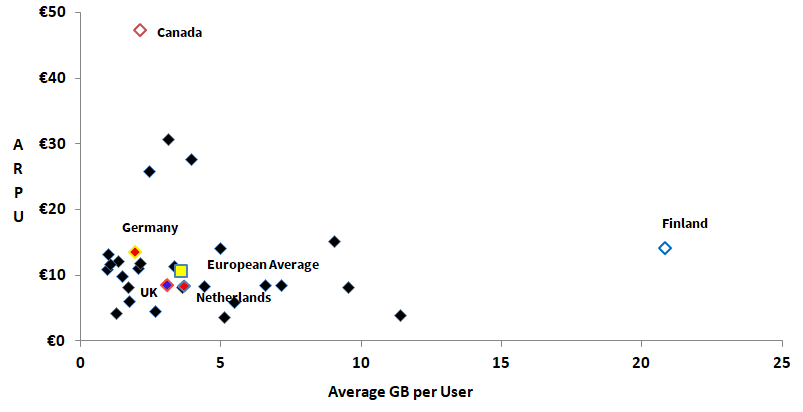

As our submissions to this proceeding painstakingly document, Canada's mobile retail costs are prohibitively high by global comparative standards. Canadians pay more per GB of mobile data than almost any other OECD or EU country. The amount of revenues Canadian mobile providers extracts from each customer is also world leading. A comparison of Canada to EU countries, mapping average service provider revenues against average data usage, demonstrates starkly how much of an outlier Canada is:

Figure 1: EU & Canada, Average Revenue per User vs Average GB per User, 2018

Figure 1: EU & Canada, Average Revenue per User vs Average GB per User, 2018

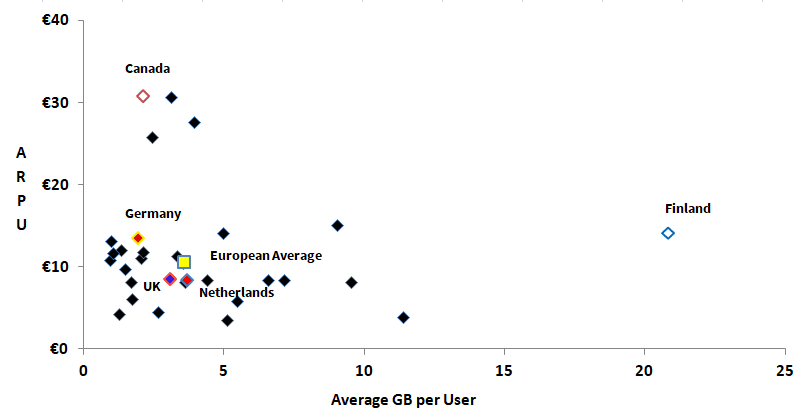

Figure 2: If MVNOs were in place by 2018, leading to 35% ARPU reduction

Canada's service provider revenues are so comparatively high that, even after including a projected 35% reduction in average revenue per user, Canadian average revenues per use would still lead all EU countries but one if applied to 2018 measures (compare Figures 1 and 2). In reality, this overestimates Canada's comparative rankings following a 35% projected rejection in Average Revenues per User, as ARPU fell across most EU countries between 2018-2019 (a year over year ARPU decrease of up to 10%), and is likely to continue to drop.

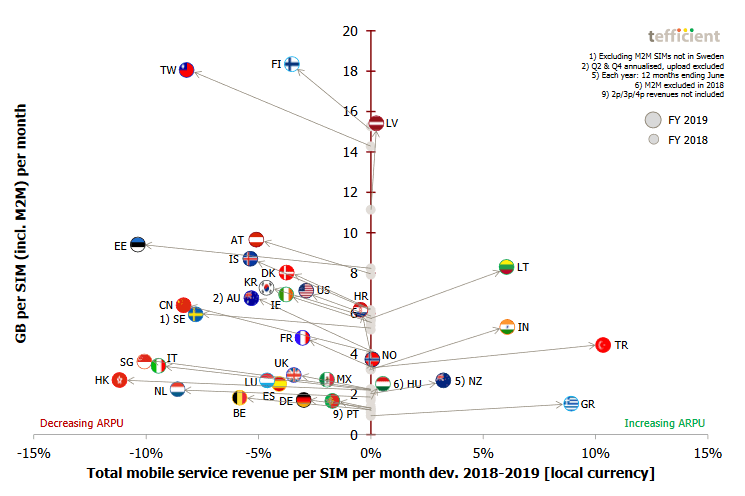

Figure 3: 2018-19 Decrease in ARPU

IMAGE SOURCE: Tefficient, Industry Analysis #2, July 10, 2020**

Figure 3: 2018-19 Decrease in ARPU

IMAGE SOURCE: Tefficient, Industry Analysis #2, July 10, 2020**

Canada is an outlier, not only to the degree that Canadian providers charge world-leading ARPU, but also because ARPU continues to claim even as technological advancements lead to reduced prices around the world.

The impact of this poor value proposition falls most heavily on Canadians, who do not make full use of their mobile devices or are priced out of mobile connectivity altogetherOn that front, Canada has fewer mobile subscribers on a per capita basis than the vast majority of OECD countries, and Canadians use barely one half the amount of mobile data as the average OECD country. Canada continues to fall further behind in terms of both adoption and data usage.

These trends have been indicative of the Canadian mobile market for years, and a robust regulatory response is required. In our final comments to this proceeding, we call upon the CRTC to mandate a wholesale regime that would allow Virtual Network Operators (MVNOs) to provide mobile connectivity over incumbent service providers networks. This will allow for an infusion of competition, while ensuring that incumbent providers are well compensated for the use of their networks.

CIPPIC and OpenMedia also called on the Commission to mandate affordable (~$20/month) mobile plans with at least 4 GB of monthly data. These plans are based on projected average usage and projected average cost per GB in 2021, the earliest time in which these plans would appear in the market if mandated.

Image Source: Falcon Photography, "The New Golden Xperia Z5", Flickr, March 15, 2016, CC-BY 2.0

Tamir Israel, Staff Lawyer, CIPPIC Note this post was updated on July 21, 2020, to add the Tefficient graph and surrounding commentary regarding 2018-19 decreases in ARPU among EU states.